- OBG Access Newsletter

- Posts

- Engagement with Strategic Partners: It's Never Too Early

Engagement with Strategic Partners: It's Never Too Early

Building a medical device business in women's health

Read time 8 minutes

It’s been a few months since my last newsletter and I’m excited to share more insights with you, on themes I see emerging from advisory work with early stage medical device companies in the women’s health space.

There’s some fantastic innovations coming to market - perhaps one I’ll share more in a separate newsletter.

On a personal note but consistent with the theme, we are super excited to share that our third baby is due in December. We’re looking forward to extending our family in an already chaotic household - wouldn’t have it any other way!

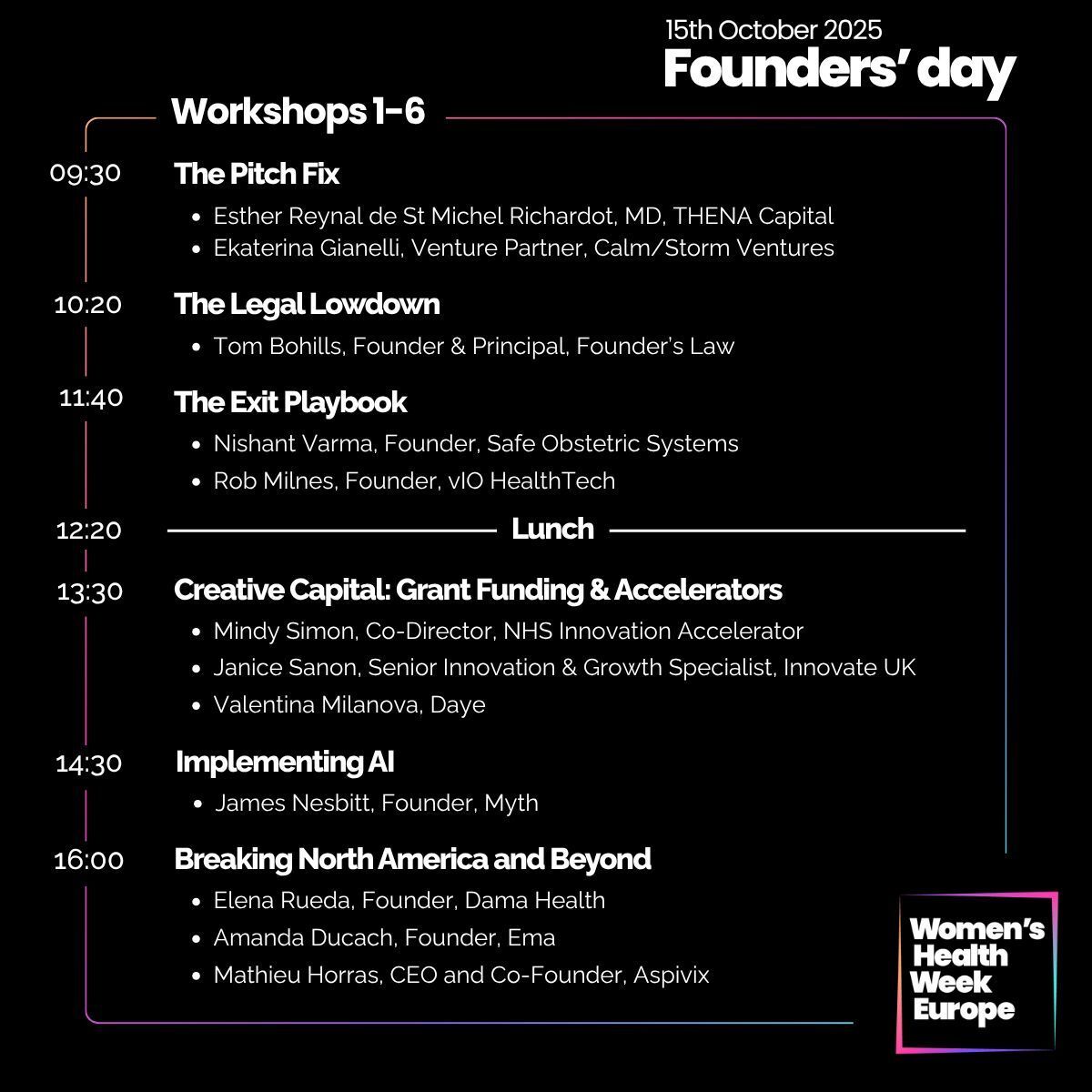

Upcoming event - I’m attending Women’s Health Week Europe 2025. I’ll be part of the Founder’s Day (agenda below) and the Exit Playbook Panel where I’ll share some of our story and leave other founders with actionable takeaways for their business.

I highly recommend this event - an incredible line up of founders, investors, major industry players, and seasoned executives. If you plan to be there, please do let me know by reply to this email. It would be great to connect.

Now let’s get into the Newsletter. When advising early stage medical device companies, a question that often comes up..."When should we start engaging with strategic partners?". My answer is that it's never too early, but you should take a considered approach.

Early touchpoints with key strategic players and their corporate development teams can help clarify endpoints and metrics they care about, which can help shape your commercial roadmap. Assuming of course, an exit is part of your strategy.

We had a relationship with our acquirer years prior to exit. On reflection, this was advantageous for several reasons:

Corporate Development- can you get your company/ product into their pipeline early, so they can track your progress? In our case, this was over multiple years. We would share updates on adoption, clinical data, and other success stories. We could demonstrate repeatable results across multiple sites and publications. When the timing was right, we would become a de-risked target for an M&A evaluation.

Strategic Fit - Does your product fit in with their longer-term strategic goals? In our case, we were interested in partners looking to strengthen their position in OBGYN and maternal/ newborn care. We knew our device was one of the few innovations in this space and would easily fit into the strategic priorities for multiple players. This was the first solution available to address an important clinical problem; we had early commercial traction; and this device could place a larger player at the forefront of innovation in this field.

Other Commercial Partnerships to test the waters. Early engagement often opens up other conversations such as: Co-development of technology, distribution pilots (in our case), or small strategic investments. These might form part of their longer-term commercial due diligence to further de-risk an acquisition opportunity.

Clinical Endpoints - what are the key clinical outcomes a strategic might be interested in? These could shed light on any future study design. The strategic will be thinking commercially around evidence needed to underpin large-scale adoption and to change the standard of care. In our case, these would also be used to develop a robust economic model.

Access to their Network - A strong early relationship might offer informal access to their sales channels and KOL networks, which can shorten the path from first pilot to multi-site adoption and revenue acceleration. Warm introductions could benefit both parties, but more importantly a strategic can start building an internal model to forecast adoption across major healthcare groups nationally.

We built our relationship over multiple years. Corporate Development teams would become familiar with us and our story. You should consider the same.

Let’ dive a little deeper into each of these points, with a specific examples.

Corporate Development Pipeline - can you be included?

Why does this matter? Corporate development teams are often managing a substantial pipeline of potential opportunities. You need to get into the pipeline and onto their radar as an initial step. They rarely act on a single press release - they track trends (you need to ensure your business is trending in the right direction).

When you start sharing structured updates early (e.g. quarterly one-pagers), you start to build a familiar, de-risked story for a potential acquirer. This might include updates on adoption within healthcare groups, number of sites approved nationally, recent clinical publications (or studies to commence), and relevant KOL engagement. This familiarity will translate to faster diligence and higher confidence if M&A discussions begin.

Examples: We didn’t have a formal frequency for updates but would share specific events or milestones during the year that might be valuable - examples would include approval at key healthcare systems (e.g. Kaiser, New York Presbyterian, Northside Atlanta etc), publication of a randomized controlled trial (Brigham & Women’s), regulatory approvals in new territories, and KOL engagement (e.g. an Editorial in a well-read publication, OBG Management). These are just a few examples that highlighted the momentum we were achieving (as a small team).

Strategic Fit - how do you fit into their long-term goals?

Why does this matter? Determining strategic fit starts with understanding their current OB/L&D offerings (devices, disposables, software, services) and where your product might fit into these lines. It also means understanding the clinical problems being addressed - are they focussed on single use disposable devices used during childbirth, or are they commercialising remote fetal and maternal monitoring technologies. Both operate in the obstetrics world but are very different in terms of strategic and commercial approach. You would also need to consider the markets the partner might not yet be operating in, but has near term plans to enter. Could your device create an opportunity for them to enter this market? This creates a potentially exciting strategic fit. A lot of this understanding is developed through direct communication.

Examples: We knew the strategic partner was heavily focused on acquisition activity, particularly bolt-on acquisitions of smaller (often single product) medical devices businesses that could easily be integrated into the product portfolio and complement existing offerings. We also knew they had a dedicated L&D sales team who could begin selling our device immediately, alongside current products. We also knew they were interested in differentiating themselves from competitors, with bringing innovative technologies into their business. We started to understand that we could meet many of these strategic goals.

Other Commercial Partnership Opportunities, prior to Acquisition

Why does this matter? There are often many creative and mutually beneficial opportunities to engage with a strategic partner, ahead of an outright acquisition. The timing might simply not be right for them. The stage of you business is also important - if you’re very early or not yet FDA cleared, a partner might be open to other ways to engage - these could include co-development of technology, early sales pilots, distribution options, or minority strategic investments. These are usually non-dilutive or minimally dilutive ways to partner, and if successful in an early pilot for example - you are already building internal champions who can advocate for a potential future transaction.

Examples: We ran a small distribution/ sales pilot prior to an acquisition discussion. The strategic would trial our product in a small number of states - our device would be given to their local sales team in those territories who would then market the device to key facilities. This was a fantastic opportunity for real-life experience from their teams in the field, and also for us to prove the potential opportunity, driven by real-world user feedback. This was one of several factors that led to our successful exit.

Clinical Endpoints - what are the outcomes a strategic might be interested in?

Why does this matter: Strategics will often share clinical endpoints they’re interested in. These datapoints will be used for their internal analysis to determine the size of the opportunity (how often your device might be used) and how they might drive adoption towards a standard of care (how challenging will it be to obtain clinical buy-in). Clinical evidence will also be used to develop an economic model (they’ll already be thinking about approval from an economic and reimbursement perspective).

Examples: We could highlight multiple publications that demonstrated efficacy, through improved maternal outcomes. We were also able to share details on a US RCT due to commence (primary and secondary endpoints). We could also design US pilots and evaluations around the right endpoints.

Access to their Commercial Network

Why does this matter: Strategics bring considerable commercial scale to the table. We always knew we needed a large partner to one day make our device a standard of care. Larger players can leverage many commercial advantages, such as: Sales coverage; contracting with IDNs/GPOs; marketing firepower; deep KOL networks; and potentially substantial capital behind them. If the potential partner understands our product and mission early on, they might be willing to offer some warm introductions within their network to obtain direct feedback from the market (e.g. end users or KOLs). They want to develop an understanding of sales cycles, training protocols, and utilization, amongst many other factors that could support a potential investment.

Examples: In our case, we were able to obtain approval of our device at key facilities that were part of larger systems (think Kaiser, NYU, HCA etc). The strategic partner now had some evidence of early traction within these key systems, but we were of course still a long way from system wide approval. The strategic partner fully understood that through their deep relationships and existing contracts with these IDNs, they could very quickly begin the process of system-wide roll outs. In many ways, we had already done a lot of the hard work - getting past the approval and purchasing committees. Now we needed a larger commercial infrastructure to drive adoption. The strategic could offer this.

I appreciate you reading this month’s topic - below I briefly share details on another project I’ve been working on, in the hopes to help startups scale and drive adoption. Please get in touch if you’d like to learn more!

New Platform Concept I’m Building

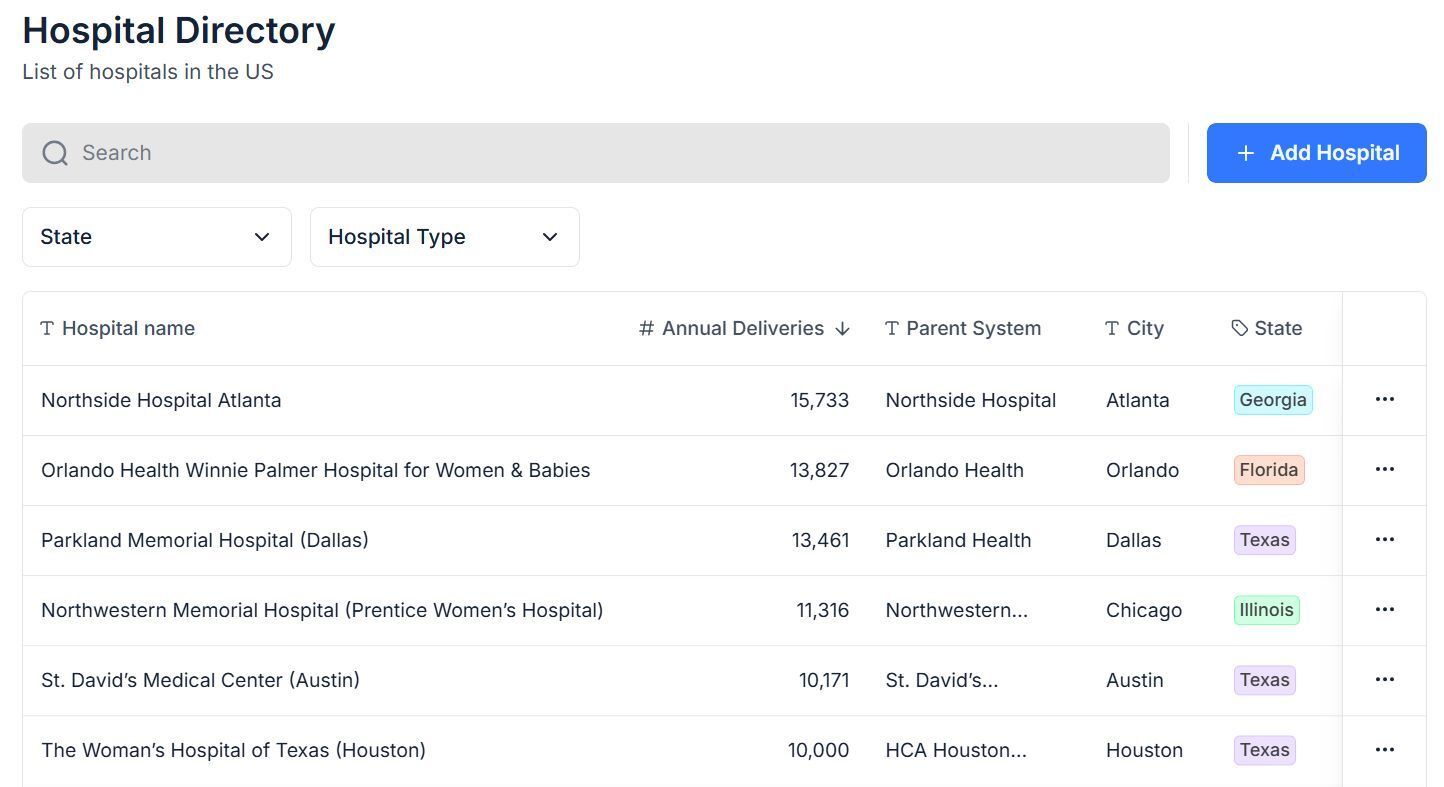

When we launched our device into the US market, we faced a key challenge: “Which hospitals should we focus on first, and who at those facilities did we need to speak with?”

I’ve been building a curated list of top birthing facilities across the US - not just by delivery volumes, but also by the influence they carry in shaping adoption, and the clinical decision makers you need to get in front of.

What makes this list different is that it’s rooted in direct relationships I’ve built with leaders in OB, L&D, and MFM over the many years spent commercializing our device in the US market.

For early stage companies, I know this could make a huge difference:

Less time spent searching directories, attending conferences, and cold outreach (although all these are important, especially the conferences)

You can identify decision makers and clinical champions early on, those that understand innovation. This means a more focused use of your time

You can build a clear roadmap of where to launch pilots that will have the most impact, and who to involve in those pilots

Access to the right clinicians, at the right facilities, is one of the biggest accelerators of adoption for a medical device in women’s health.

That’s why I’m excited to share a snapshot of this resource and connect it with the broader commercialization tools that I’m building.

If you’re a women’s health startup preparing for a US launch, I’d love to share details on how this might benefit your journey.

If you're interested in such a platform, drop me a message and I'll add you to the list for details on its release.

This was a side project to create something that might be helpful for other companies. I know it's something we could have used back then.

Snapshot of the current database

As always, thank you for taking the time to read this month’s newsletter. I hope there’s an insight that you can apply to your own journey.

Please reach out if you have a specific question - happy to set up a call to discuss any topic in further detail.

Have a wonderful weekend!

Nish Varma